GSE Recap/Release: About That Litigation Risk Posed by GSE Common Stockholders In Event of Treasury's SPS Conversion

Treasury must amend the Senior Preferred Stock Agreement (PSPA) to convert GSE Senior Preferred Stock (SPS) into Common Stock. Will this trigger another damage lawsuit from GSE common shareholders?

It occurs to me that in the event Treasury converts its SPS into common stock in a GSE recap/release, GSE common stock holders will have a stronger claim for damages than I previously considered and posted. This claim would arise from a breach of the GSEs’ implied covenant of good faith and fair dealing (implied covenant) owed to GSE common stockholders.

I discussed this concept previously at If Treasury Doesn't Cancel the SPS in a GSE Recap/Release, Will GSE Shareholders Have a Second Breach of Implied Covenant of Fair Dealing NWS Case?.

In brief, a federal jury found that the implied covenant was breached by the imposition of the Obama Net Worth Sweep, because the plaintiff class of GSE common shareholders had no reasonable expectation that the SPSA would be amended to permit the SPS to absorb as dividends the entire net worth of the GSEs.

In the post, I characterized any SPS conversion in a GSE recap/release simply as a closing bookend entry to the Obama Net Worth Sweep. The claim of breach from SPS conversion would, in effect, piggyback on the breach found with respect to the Obama Net Worth Sweep.

However, it strikes me that an even stronger argument for breach of the implied covenant can be asserted by common shareholders against any SPS conversion, arising from the necessity for Treasury to amend the SPSA to allow conversion.

In essence, an implied covenant breach would be premised on the assertion that, while GSE common shareholders may be held to have a reasonable expectation that SPS would be converted if Treasury had claimed that right for itself under the SPSA, GSE common shareholders would not have a reasonable expectation that the SPSA would be amended for Treasury to claim that right…especially after Treasury had already received more than enough payments to economically pay off the SPS in accordance with its original terms.

The GSE common shareholders would ague that if it was a breach of the implied covenant of good faith and fair dealing to amend the SPSA to sweep all GSE net worth as dividends, it is likewise a breach of the implied covenant to amend the SPSA to squeeze out common shareholders after Treasury’s SPS has been economically paid off.

If Treasury had the right under the SPSA without amendment to institute the Obama Net Worth Sweep, then it would be foreseeable by GSE common stockholders that Treasury could exercise that right, and there would be no breach of the implied covenant.

Likewise, if Treasury had the right under the SPSA without amendment to convert its SPS into common stock, then it would be foreseeable by GSE common stockholders that Treasury could exercise that right, and there would be no breach of the implied covenant.

However, in the case of both the Obama Net Worth Sweep and any Treasury conversion of SPS into common stock, GSE common shareholders are entitled to rely upon Treasury’s rights as specified in the SPSA, and not be held to be on notice regarding the exercise of any and all rights that Treasury might create for itself anew by self-interested amendment of the SPSA.

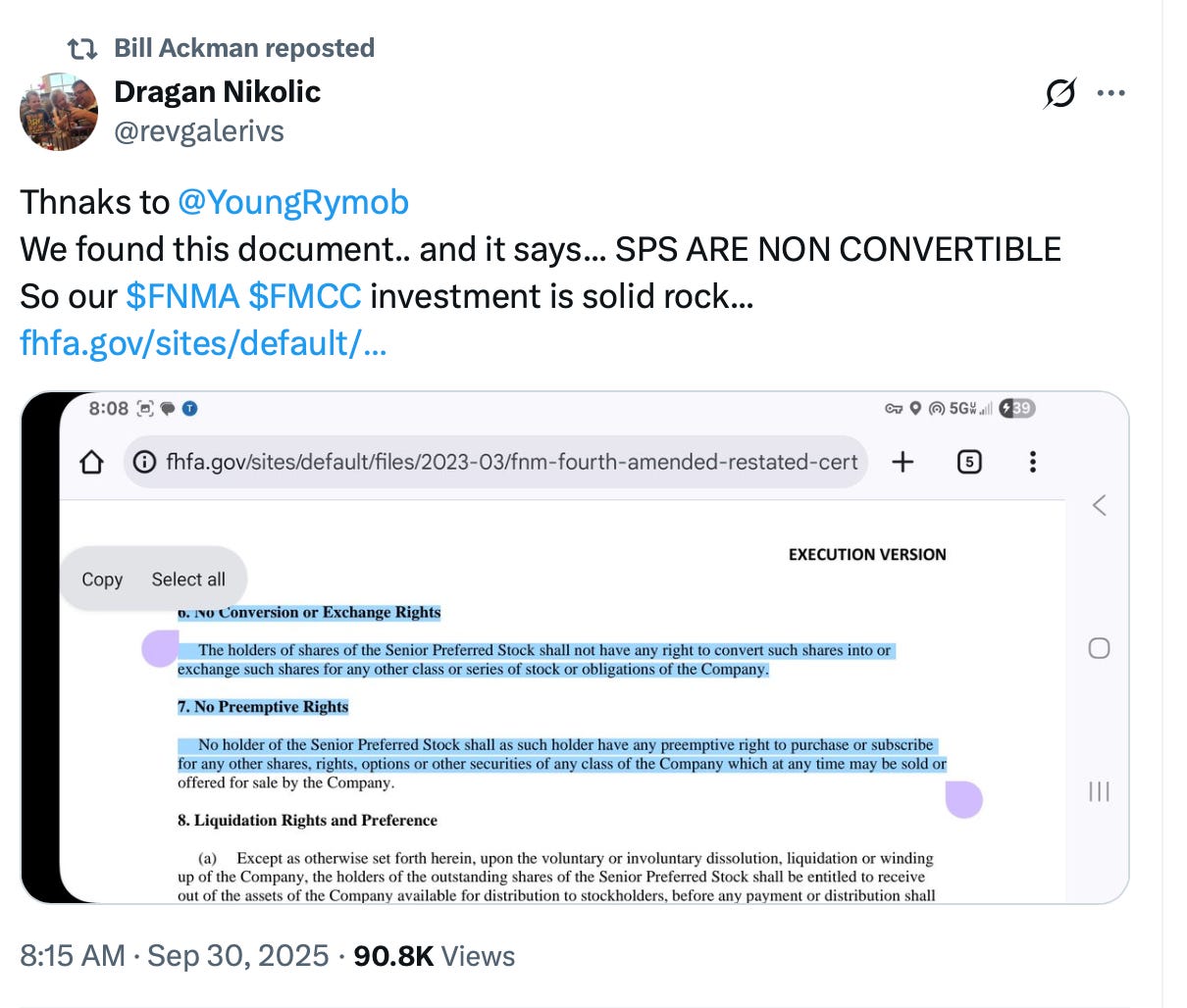

This line of reasoning occurred to me after reading a tweet reposted by Bill Ackman (whose Pershing Capital is reportedly a 10% common stockholder of each GSE), set forth below:

The SPSA as amended disclaims any right of Treasury to convert the SPS into common stock. It is not silent on the question, it affirmatively disclaims the right. This disclaimer of any SPS conversion right served the interests of Treasury at the time the SPSA was entered into.

It is my best guess that Treasury counsel made sure to affirmatively disclaim this conversion right in the SPSA because it wanted to make sure that the GSEs would not be consolidated with the US, thereby putting the GSEs’ debt on the US balance sheet. Given that Treasury already could exercise at its option warrants to own 79.9% of the GSEs’ common stock, it would be important for Treasury to disclaim any right to convert at its option the SPS into common stock.

If Treasury reserved for itself in the SPSA the ability at its option to use the SPS to cross the 80% common stockholding threshold that results in control and debt consolidation for financial accounting purposes, then Treasury would be subject to the argument by the General Accounting Office that the US must consolidate the GSEs’ debt.

Can Treasury enter into a PSPA amendment to further amend the PSPA to allow this conversion? Certainly, Treasury has that contractual power.

But GSE common stockholders will have a strong claim for breach of the implied covenant that the exercise of that contractual power is not within the ambit of the GSE’s duty of good faith and fair dealing when Treasury had affirmatively disclaimed that contractual power in the agreement.

Of course, one may wonder what Treasury’s intent would be to cross the 80% debt consolidation threshold through conversion in a GSE recap/release, given that both Treasury Secretary Bessent and Commerce Secretary Lutnick have intimated in public media interviews that Treasury is not looking to sell a major common stock stake in an initial GSE recap/release transaction.

* * * * *

As always, this substack provides investment analysis, not investment advice. Do your own due diligence.