Will GSE Recap/Release Increase Mortgage Interest Rates? Survey Says...

Treasury Secretary Bessent Will Focus on Whether GSE Recap/Release Will Increase Long Term Mortgage Rates. The Best Way to Answer This Question Is To Survey Knowledgeable Market Participants.

Treasury Secretary Bessent recently stated “[a]nything that is done around a safe and sound release [of the GSEs] is going to hinge on the effect on long-term mortgage rates”. Bessent went on to say that he will look to see whether there is any study or hint that shows that the “metric” of long term mortgage rates will increase upon a GSE recap/release.

I discuss below the best approach to answer this question, as well as other considerations. At the outset, however, let’s be clear: there is no definitive answer in advance to this question simply because:

there has never been a prior GSE conservatorship release to study;

there are no highly comparable precedents that serve as informative examples to study1; and

many market commentators (such as the Urban Institute) can’t be relied upon since they are conflicted by undisclosed funding sources and biases that call into question their analysis.

The best source of prediction is simply to survey knowledgeable secondary mortgage finance market participants as to whether they believe GSE recap/release will raise long term mortgage rates, if so by how much, and what are the reasons for their views.

Below, I review an important survey conducted by J.P. Morgan of its customer MBS market participants regarding mortgage rates and a GSE recap/release on various terms. After that, I review the statement of the only credit rating agency which has publicly weighed in on GSE recap/release. Finally, I assess what one market commentator, the Urban Institute, has to say, and why what it has to say can be disregarded.

By obtaining the views of knowledgeable market participants concerning a GSE recap/release, it becomes apparent that an explicit federal MBS guarantee (and Congressional legislation required for it) is completely unnecessary for a successful GSE recap/release that does not disturb mortgage rates. An administrative GSE recap/release, depending upon its terms, will have a de minimus effect on long term mortgage rates.

The purported need for an explicit federal MBS guarantee, as insisted by antagonistic GSE market commentators such as Urban Institute, is nothing but a dishonest roadblock intended to prevent administrative GSE recap/release.

This is a free post without paywall. I encourage you to forward this post to others, or find it on my substack, and to become a paid subscriber if you like this post, in order to support my work.

The J.P. Morgan Survey of MBS Market Participants

J.P. Morgan (North American Securitized Products Research) polled institutional investors buying Fannie and Freddie MBS as to their predictions whether and how much GSE recap/release will affect long term mortgage rates.

In my view, this survey (released 1/24/25) is the best prediction as to the mortgage rate effects of GSE recap/release for Treasury Secretary Bessent to rely upon.

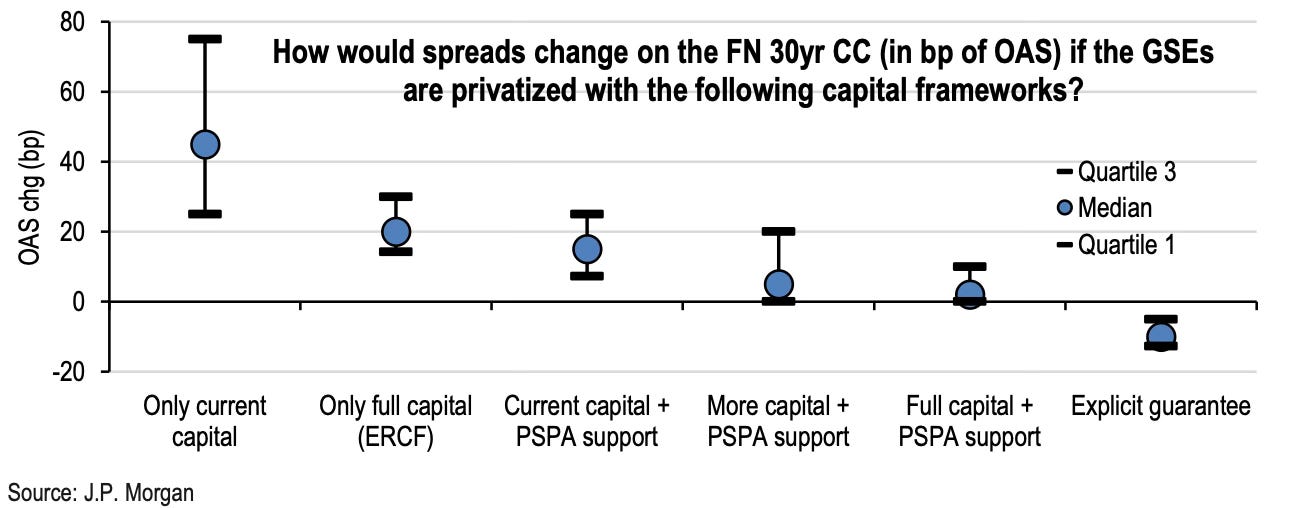

J.P Morgan’s survey of MBS institutional investors, set forth below in graphic form, reveals that if there was a GSE recap/release, mortgage rate spreads (the premium above 10 year Treasuries) (“Spread”) would be sensitive to the

(i) level of capital that the GSEs retain, and

(ii) whether a committed Treasury line of credit or backstop (akin to the Preferred Stock Purchase Agreement or PSPA in existence today) continues to exist.

The Y vertical axis (OAS or option adjusted spread change) is a measurement of the predicted change in Spread (“Spread Change”) in basis points (bp=.01%) resulting from a GSE recap/release.

As the above figure clearly demonstrates (reading the figure from left to right),

(i) a GSE recap/release based upon current capital levels and without a Treasury backstop created the greatest uncertainty among participants (widest range of Spread Change), and resulted in a predicted Spread Change of approximately 25-75bps,

(ii) a GSE recap/release based upon capital levels required by the ECRF (GSE equity essentially >4% of assets) and without a Treasury backstop resulted in a predicted Spread Change of approximately 15-30bps,

(iii) a GSE recap/release based upon current capital levels and with a Treasury backstop resulted in a predicted Spread Change of approximately 5-25bps,

(iv) a GSE recap/release based upon capital levels in between current levels and that required by the ECRF and with a Treasury backstop resulted in a predicted Spread Change of approximately 0-20bps, and

(v) a GSE recap/release based upon capital levels required by the ECRF and with a Treasury backstop resulted in a predicted Spread Change of approximately 0-10bps.

A release from conservatorship with an explicit federal guarantee, (the furthermost right data point) is something that I suspect neither Treasury Secretary Bessent nor a majority in Congress will contemplate, because of the implications it would have for the national debt.

The good news is that knowledgeable market participants do not believe an explicit federal guarantee is necessary. As this survey indicates, an explicit federal MBS guarantee would provide only an insignificant predicted reduction (5-10bps) in Spread.

The important takeaways from this survey can be summarized as follows:

it is important to focus on the terms of an administrative GSE recap/release (levels of equity capital and Treasury backstop), as opposed to debating the merits of GSE recap/release in the abstract,

a safe and sound GSE recap/release (for example, per (iii), (iv) or (v) above) is NOT expected by market participants to disrupt long term mortgage rates, and

an explicit federal MBS guarantee is not necessary2.

Before I continue, it occurs to me that there may be a “sweet spot” for the terms of a GSE recap/release that should not go unappreciated by Treasury, FHFA and the GSEs in setting the terms of the GSE recap/release.

This “sweet spot” in my view would argue for a GSE recap/release according to the terms contained in (iv) above. Both “too much” GSE capital and “too little” GSE capital can lead to higher mortgage rates than would be the case with GSEs having an optimal capital level.

To explain, if the GSEs are required to maintain “too much” capital, the GSEs would need to increase their guarantee fee to earn the requisite return on this higher capital level to satisfy the equity markets post-conservatorship.

This will increase mortgage rates generally by the amount of the incremental guarantee fee, since all mortgage originators will quote interest rates by reference to the GSEs’ market clearing bid (including the higher than optimal guarantee fee), whether or not their mortgages are ultimately sold to the GSEs.

On the other hand, if the GSEs maintain insufficient capital, MBS buyers will discount the creditworthiness of the MBS guarantee to some extent, and look for a higher return on the MBS. This will in turn pressure the GSEs to lower their purchase prices for mortgages, resulting in a higher mortgage rate charged by the originators.

If this is correct (as I believe it is), it may lead one to believe that the lower Spread Change anticipated by market participants in scenario (v) compared to scenario (iv) above may not materialize if the GSEs feel compelled to raise their guarantee fee in scenario (v) compared to the guarantee fee in scenario (iv).

A Rating Agency’s Point of View

As we see from the J. P. Morgan survey, knowledgeable market participants in the MBS market expect GSE recap/release will have a de minimus effect on mortgage rates, especially if a committed Treasury backstop (paid for at Treasury’s insistence) is retained.

What must be added to this headline J. P. Morgan survey is that there are additional factors that might affect mortgage rates that also should continue without change in connection with GSE recap/release.

For example, the Fed’s authorization to purchase GSE MBS must continue after conservatorship release, just as it existed before the GSEs went into conservatorship, and just as it exists now in conservatorship. Briefly, the Fed has considered GSE debt and GSE MBS to be government agency securities given their GSEs’ federal charters, allowing them to legally purchase GSE MBS and debt. This status as federally-chartered government sponsored enterprises can be expected to continue post-GSE recap/release.

Additionally, the banking industry’s regulatory cost imposed on banks to hold MBS in portfolio (eg the capital risk weights assigned to GSE MBS) should remain unaffected post-conservatorship release.

It can be expected that FHFA, Treasury and the GSEs will coordinate with the Fed and federal banking regulators in connection with the GSE recap/release to ensure that all federal agencies are aligned with the process.

Another additional factor, highlighted by Urban Institute and which I discuss below, is whether GSE release/recap portends a reduced importance for housing finance accorded the GSEs by the federal government. Another way of expressing this factor is whether GSE recap/release will cause the market to lose the perception, which predated conservatorship and continues in conservatorship, that there is an implicit federal guarantee of GSE MBS if necessary beyond Treasury’s committed line of credit.

Just as the market perceives that money-center national banks such as J.P Morgan, Bank of America, Citicorp and others to be too big to fail, so that their obligations benefit from an implicit understanding that they will be bailed out if necessary to avoid untenable financial market disruption, the GSEs are perceived as similarly too big too fail.

To avoid bailouts in all such cases, regulators (FHFA in the case of the GSEs) rightly focus on capital adequacy and safety and soundness of financial condition and business operation of the too big to fail institutions to avoid the consequences of confronting the necessity of a bailout.

But after GSE recap/release, Urban Institute and others impertinently argue that the GSEs will lose their implicit guarantee post-conservatorship release, for reasons they don’t substantiate. They argue that this will result in GSE MBS credit ratings downgrades and consequently higher mortgage rates.3

I call this a “fear smear” campaign.

Fitch Ratings takes on this “fear smear” straight on.

Fitch recently expressed its credit rating view on GSE recap/release. Fitch stated:

GSEs “exiting conservatorship would be incrementally credit negative but unlikely to immediately affect ratings on its own” (emphasis added), and

“Fitch would instead evaluate the ongoing availability of financial support to the GSEs and their continued systemic importance to the U.S. housing market’s overall functioning.” (emphasis added)

So, in Fitch’s view, there is nothing inherent in the notion of conservatorship release that requires Fitch to downgrade GSE unsecured debt (which is equivalent in creditworthiness to the GSE guarantee of MBS). The GSEs will continue to have “systemic importance to the US housing market”, as multi-trillion dollar entities providing the dominant sources of liquidity for the secondary mortgage finance market, without which the US housing industry would disintegrate.

Fitch is only confirming the obvious when it confirms that it will evaluate the systemic importance of the GSEs post conservatorship release.

As Fitch goes on to make clear, it will rate the GSEs preliminarily on a standalone basis, based on their inherent financial creditworthiness:

“Fitch would rate Fannie and Freddie on a standalone basis considering their monoline business models and product concentration, counterbalanced by strong capitalization levels.”

What does Fitch really mean when it refers to (i) the GSEs’ rating on a “standalone basis”, and (ii) their “continued systemic importance to the US Housing market’s overall functioning”?

Reading between the lines, Fitch is looking for any indication that the Fed will stop viewing GSE MBS as legal and appropriate securities for it to purchase, or that bank regulators will make it more expensive from a regulatory capital point of view for banks to hold GSE MBS in portfolio, or that Treasury will make clear to the market by public pronouncement that the GSEs are not too big to fail.

These factors will be layered onto Fitch’s standalone GSE credit analysis to provide further support for a superior credit rating, higher than that on a pure standalone basis.

There have been no indications from the Fed and banks regulators that they will change policy post GSE recap/release, or that Treasury will declare that the GSEs are not too big to fail. There has only been the fear smear from the likes of Urban Institute to that effect, which Fitch is in effect addressing.

The GSE reap/release will be a coordinated intra-governmental effort, and you won’t see the Fed, Treasury or bank regulators adopt policies that kneecap the GSE recap/release process once it proceeds.

Fitch acknowledges this.4

GSE antagonists such as Urban Institute do not acknowledge this. Let’s turn to their recent apoplectic complaint now.

Urban Institute and the Fear Smear

First off, who is Urban Institute (“UI”) and why is it a GSE release/recap antagonist?

UI is a not-for-profit NGO that obtains roughly half of its funding from seven unidentified funding sources (UI's Form 990 for 2022, Schedule B, Part I)

UI does disclose that it obtains roughly a third of its annual funding from the US federal government, and another third from private foundations (such as the Gates Foundation). Given that the Biden administration had no interest in even considering GSE recap/release for four years, it makes sense that UI would act as a paid surrogate to foment GSE antagonism funded by a prior administration antagonistic to GSE conservatorship release.

Urban Institute recently posted a fear smear piece entitled "Fannie and Freddie’s Implicit Guarantee— Another Iceberg on the Path to Privatization" (“Iceberg”, as if GSE recap/release is the Titanic), and held a virtual event entitled Recapitalizing the GSEs through Administrative Action: Impact on Mortgage Rates and the MBS Market (“UI Event”) on 2/13/25 that I discuss below.

First let’s address the Iceberg, written by one of UI’s “nonresident fellows”, James Parrott (who you may remember as a “fellow traveller” who rejoiced in an email he sent at the time of the Net Worth Sweep adoption that the GSEs would never be able to become private entities again; Parrott is the exemplar GSE conservatorship release antagonist), and Mark Zandi, of Moody Analytics and a frequent speaker at UI-sponsored events (Iceberg doesn’t state on its face that it was commissioned by UI, but since it appears on the UI website for download, this is a fair assumption).

It is important to note at the outset that Parrott and Zandi in Iceberg cite no studies, data or market participant surveys.

Parrott and Zandi state

“It would take legislation to provide the GSEs with an explicit, unlimited government guarantee upon their release from conservatorship. Releasing them without Congress, as the Trump administration is apparently prepared to do, raises the question of where the government’s support of the enterprises would

end once they are released.”

Urban Institute is seeking to have GSE recap/release proceed through Congressional legislation with an explicit federal MBS guarantee, rather than administratively without an explicit guarantee. This is a transparent attempt to maintain the status quo of the GSEs in conservatorship, since Urban Institute is aware the likelihood of Congress authorizing a multi-trillion dollar guarantee authority of GSE MBS is nil.

Parrott and Zandi then proceed by straw man argument.

Parrott and Zandi raise the straw man by postulating that an administrative GSE recap/release will require the federal government to dishonor the market perception that the federal government would step in to bail out the GSEs to avoid a national financial calamity in the remote event that the regulated GSEs burn through their expected recap/release fortress financial position, expected to be more than $400 billion in aggregate amount of GSE equity capital and committed Treasury backstop.

First off, one should ask how likely is this risk of needing additional federal financial support? Remember, in the latest Dodd/Frank severe stress test scenario,5 the GSEs suffered NO LOSSES but rather earned an aggregate cumulative $10 billion over the 10 quarter test period of severe national economic stress.

Parrott and Zandi do not mention the GSEs’ stellar financial results from the most recent Dodd/Frank severe stress test, because that would involve a reference to data, which they avoid, apparently especially data that disproves their argument.

This Parrott/Zandi straw man is further stuffed with fear and smear straw when they state

“The Trump administration will thus presumably go to some pains to argue that once it releases the GSEs there will be no such taxpayer support beyond the PSPAs. Rather, shareholders and creditors, not taxpayers, would bear the cost of the GSEs’ failures the next time around.” (emphasis added).

Why do Parrott/Zandi leap to this presumption?

It furthers their fear smear objective to stop the GSE administrative recap/release process. Isn’t it far more likely that Treasury, in deciding to proceed with administrative GSE recap/release, would not address the whole issue of the market’s perception of an implicit federal guarantee?

The simple retort to Parrott’s and Zandi’s fear smear is that if GSE recap/release proceeds administratively as expected, the Trump 47 administration will not shoot itself in the foot and call into question the systemic financial importance of the GSEs post-conservatorship release.

It does not take a financial markets savant to expect Treasury to point to the GSEs’ fortress-like combined equity capital and Treasury’s paid-for line of credit backstop to substantiate the soundness and safety of the GSE release/recap, and decline to address any question relating to the presence or absence of a implicit guarantee going forward.

To point out the obvious to Parrott and Zandi, it is a fact of financial life in the United States that multi-trillion dollar financial institutions are too big to fail. Full stop. Nothing written by Urban Institute, Parrott and Zandi will disprove this reality. This applies to many financial institutions in addition to the GSEs, such as Bank of America, J.P, Morgan, Citicorp and similar money-center banks.

Indeed, one does not know how far systemic support extends. Former Treasury Secretary Yellen bailed out uninsured depositors of Silicon Valley Bank under Treasury’s “emergency” powers in March 2023, and SVB only had about $200 billion in assets. Did UI, Parrott and Zandi argue against this example of the federal government acting upon an implicit guarantee of bank depositors beyond FDIC’s explicit but limited deposit insurance when this occurred, on the premise that because there is FDIC deposit insurance, there could not be further federal financial support? Why treat the GSEs differently?

In dealing with questions of federal support for large financial institutions, strategic silence is a feature, not a bug.

As for the UI Event, UI stated that a video recording of the event will be posted to its website after the call. As I write this, that video has not yet been posted, but I expect it will be posted here.

The biggest takeaway from this zoom discussion is that messaging by Treasury Secretary Bessent is very important in connection with GSE recap/release.

Upon GSE recap/release, Treasury should not disturb the market perception that there is an implicit federal backstop beyond the committed Treasury line of credit.

There is current market perception that there exists federal support beyond Treasury’s current PSPA line of credit with the GSEs in conservatorship. The zoom participants agreed that it is important for this market perception to continue after conservatorship release (because of the systemic importance of the GSEs), and Treasury Secretary Bessent should make no proclamations to the effect that further federal support beyond Treasury’s line of credit would not be available.

As for specific comments from the zoom meeting, Warren Kornfeld from Moody’s rating agency went through what he would expect Moody’s credit ratings analysis would be of the GSEs post recap/release.

His comments track the statement put out by Fitch discussed above. In its credit ratings analysis, Moody’s would look to the earnings power of the GSEs, their capital levels, the size of the Treasury line of credit and finally, the continued existence of federal implicit support for the GSEs given their systemic importance to the nation’s housing market and economy.

* * * * *

As always, this substack provides investment analysis, not investment advice. Do your own due diligence.

The Resolution Trust Corporation’s resolution of the S&L crisis in the early 1990s involved a resolution process involving a massive asset sale and securitization program of real estate and loan portfolio assets over an extended period of time, in which over 700 S&Ls were liquidated. This is very much different than a straightforward recapitalization of the GSEs, and their continued regulated operation outside conservatorship as safe, sound and highly profitable entities. FDIC’s resolution of bank failures also is inapposite, since the FDIC focuses principally on maximizing the sale of bank deposits and bank assets to recoup FDIC outlays under its deposit insurance obligation.

Indeed, Josh Rosner of GrahamFisher argues that an explicit federal GSE guarantee would create market dislocations that would adversely affect the Treasury market and thus long term rates generally. “GSE MBS spreads would compress relative to Treasuries, but not to zero, due to negative convexity and prepayment risk. However, this shift would induce a rebalancing across fixed-income portfolios, with broad implications for Treasury yields and GNMA funding costs.”

To be consistent, Urban Institute and others would also have to argue that after the money center national banks were bailed out in the Great Financial Crisis, the banks are no longer too big to fail and no longer benefit from an implicit federal bailout guarantee if necessary to avoid national financial calamity. But Urban Institute and others are not consistent.

Fitch refers to this intra-governmental coordination at the end of its statement: “As part of a potential conservatorship exit process, the FHFA would conduct a market impact assessment, seek public comment on potential proposals for ending conservatorship, and brief the Financial Stability Oversight Council on public feedback. The FHFA would then recommend an approach to the Treasury, considering public comments and potential housing market impacts. Before consenting to the GSEs' release, the Treasury would also consult with the sitting U.S. President.”

The severe stress test models, among other things, a U.S. real GDP decline by nearly 8.75 percent from the fourth quarter of 2022, reaching a trough in the first quarter of 2024 before recovering“ and the “rate of unemployment increases by about 6.5 percentage points compared to the beginning of the planning horizon, reaching a peak of 10 percent in the third quarter of 2024”.

Excellent work and rebuttal of what the GSE foes are spreading on both sides of the Hill; urge you to share it with members of Senate and House Banking Committees to challenge what the MBA, UI, Moody's and others are propagating.

If you do that, you might also suggest those congressional folks look closely at Moody's role in the PLS debacle on 2007-2008 and the costs of the MBA's proposal (to put various GSE debt and MBS on budget).

Great one!