GSE Recap/Release: Summarizing Deutsche Bank's GSE Valuation Report

And Commerce Secretary Lutnick talks on CNBC about a GSE stock offering that "could be this year," since he believes "a deal is going to be struck" that "could be the biggest IPO ever".

Deutsche Bank (“DB”) is out with an initiation of coverage of Fannie Mae and Freddie Mac, with a Buy Rating on FNMA and a price target of $20/share.1

This is a big deal, since DB is the first “bulge bracket” investment banking firm (ie prospective lead underwriter) with investment coverage on Fannie Mae. If indeed the GSE recap/release process proceeds, you will see additional prospective lead underwriting firms initiate coverage in the near future.

DB uses a blended expected value analysis that assigns probabilities to various scenarios involving:

Whether Treasury’s senior preferred liquidation balance (“SPS”) will be converted into common stock or cancelled;

Whether Fannie Mae will be required to maintain the statutory minimum 2.5% of equity capital or the enhanced equity capital standards of the Enterprise Regulatory Capital Framework (“ERCF”) that with buffers amounts to more than 4% of equity capital; and

Whether Fannie Mae will be permitted by FHFA to raise guaranty fees to enhance its targeted return on equity capital (“ROCE”) from current levels, which will entitle Fannie Mae to an enhanced price earnings multiple and hence valuation.

This gives rise to four scenarios:

It is worth noting that DB considers Scenario 1 (SPS cancellation, full ERCF required and modest increase to guaranty fees) to be the most likely scenario incorporated in a GSE recap/release.

This scenario would seek to assure MBS investors that the mortgage interest rate spread to treasuries won’t expand, and promote housing affordability by limiting the amount of guaranty fees that would be added to mortgage interest rates for conforming mortgages bought, securitized and guaranteed by the GSEs.

This may be contrasted with Bill Ackman’s assumptions in the Pershing Square GSE Slide Deck that the SPS would be cancelled and only the statutory 2.5% equity capital standard would be applied. This is Scenario 3 above in DB’s analysis (Bull Case).

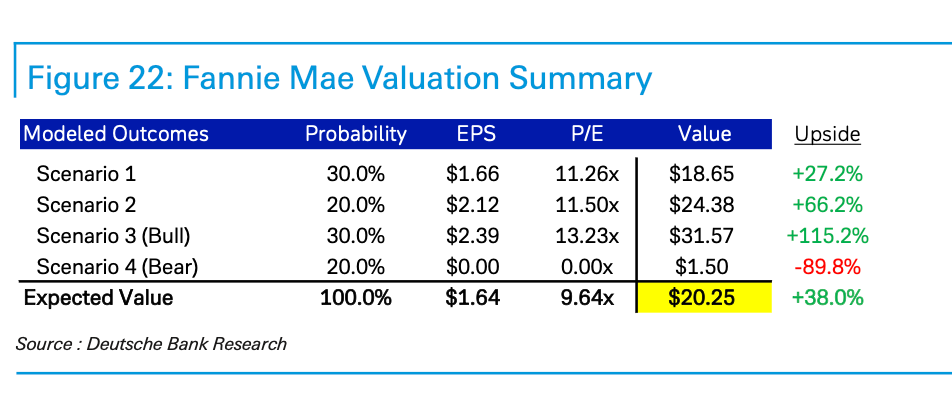

DB’s analysis concludes that the four scenarios would result in the following FNMA IPO pricing:

In my view, the probability assigned by DB to scenario 4 (20%) is far too high. This is the “crapping in your bed” unforced error I discussed in GSE Recap/Release and Price Reflexivity. I don’t expect someone as savvy as Treasury Secretary Bessent will support this approach.

Notice also that the projected offering price under Scenario 3 ($31.57/share) is almost identical to Ackman’s valuation work, given the common assumptions as to (i) SPS cancellation and (ii) application of the statutory capital standard as opposed to the ERCF.

Even assuming that Treasury’s SPS is cancelled (Scenarios 1-3), there is a 69% spread between the low and high end of values arrived at by DB. Until the terms of the GSE recap/release are spelled out, no investor can be confident as to what deal has been struck in terms of requisite equity capital, future guarantee fee levels and permitted ROCE) and other factors.

But will a deal as to these matters be struck by the Trump 47 administration during the remainder of 2025?

Here is Commerce Secretary Howard Lutnick saying that he thinks “a deal is going to be struck” and GSE recap/release will proceed “sooner than people think” (starting at 22:05 in the video).

As Lutnick says, “the President wants to show a mark to market” for the valuation of the GSEs, to show taxpayers how valuable the GSEs are. As DB shows, any such mark to market is likely going to be north of current values.

* * * * *

As always, this substack provides investment analysis, not investment advice. Do your own due diligence.

As is my custom since I own only Fannie Mae securities, I will focus on DB’s discussion of Fannie Mae.